If that is the case, selling your house will certainly give you just enough money to purchase one more home for virtually the same price. Buying the 3 discount rate points would cost you $3,000 in exchange for a savings of $39 each month. You will need to maintain the house for 72 months, or six years, to recover cost on the point purchase. Due to the fact that a 30-year financing Extra resources lasts 360 months, acquiring factors is a wise move in this instance if you plan to stay in your brand-new house for a long period of time. If, on the various other hand, you prepare to remain for just a couple of years, you may want to buy fewer points or none in any way. There are various calculators available on the net to help you in determining the appropriate quantity of discount indicate buy based upon the length of time you prepare to have the home.

When you pay discount factors, you're basically pre-paying some of the passion on a funding. The even more points you pay at closing, the reduced the rate of interest will certainly be over the life of the car loan. This can help make month-to-month payments much more budget-friendly and also save cash in interest over the long term. Whether it's worthwhile to spend for discount points depends on the funding rates offered as well as how long you prepare to remain in the residence. For example, lots of loan providers will provide debtors a reduction of 25 bps if they decide to have their month-to-month repayment auto-deducted from their checking account.

- Basis points are often utilized instead of percentage factors when distinctions of less than 1% are purposeful as well as have a substantial impact.

- If rate of interest are at 4.75% and decrease to 4.6%, that is a 15-basis factor (0.15%) decline.

- It's additionally essential to keep in mind that changes of a couple of basis points are more crucial to the lender than they need to be to you as the borrower.

- Deal benefits and drawbacks are established by our content team, based upon independent research study.

- An excellent instance, particularly when it comes to institution loans, is the discount rate applied for enrolling in autopay or making a defined variety of on-time settlements.

When people contrast fund expenditures, they measure the distinction in basis factors. A fund with costs of 0.45% is said to be 5 basis points a lot more expensive than one with a 0.40% ratio. Expenditure proportions of investment funds are often priced estimate in basis points.

Do Basis Points Affect The Mortgage Loaning Process?

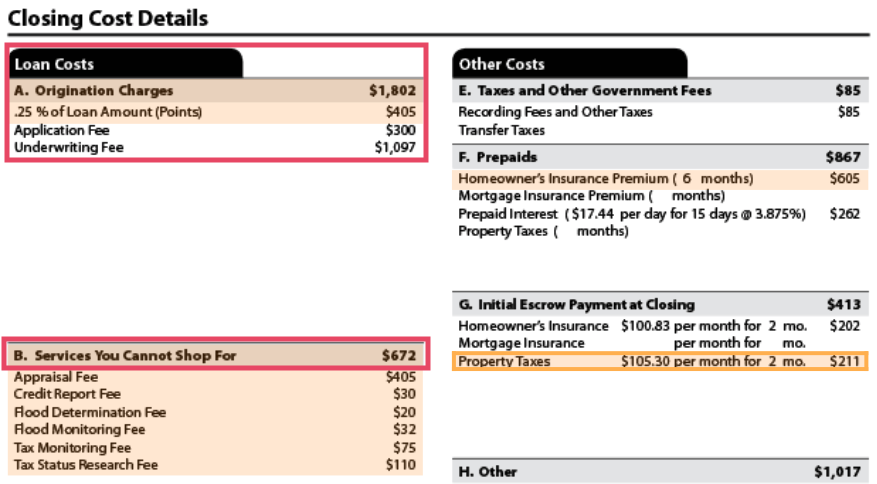

A measurement (e.g. 1-year Treasury Expense) that is made use of when computing the brand-new interest rate on a flexible price home loan. A government sponsored business which purchases and securitizes home mortgages for resale in the second market and sets criteria for home loan underwriting. The quantity transferred with a neutral third-party, called an escrow agent, who holds the debtor's escrow settlements to disburse and distribute monies to appropriate events associated with a real estate purchase. A basis point is a system of measurement that is utilized to define rate of interest variations.

Bankrate

Each point you get expenses 1 percent of your complete financing quantity. Weekly, Zack's e-newsletter will resolve topics such as retirement, financial savings, car loans, mortgages, tax and financial investment methods, and also extra. Even moderate basis point walks can raise payments and also home loan insurance costs. Capitalists additionally describe basis factors when discussing the cost of common funds and exchange-traded funds. Generally, fund expenses are revealed as a yearly percent of properties. As an example, the "Capitalist" share course of Vanguard Total Stock Exchange Index, the biggest supply mutual fund, has costs of 0.17%, or 17 basis factors.

Just How To Accomplish Cash Objectives

The term "basis factor" first arised in the 1870s to explain a device of procedure used in design illustrations. As can be seen with the home mortgage example, individuals usually use bps because % computations can rapidly obtain confusing with smaller numbers. Most of us consider percents as being 0 to 100, so when we start entering decimal points, it appears to resist the whole purpose of using percentages.

Generally, you need to just pay what a time share these types of factors if you plan to hold the lending long enough to recover the upfront prices through the reduced rate. The maximum portion factors that a financing's rate of interest can boost by during any modification duration throughout the life of the lending. A home loan created the purpose of funding a realty purchase.

Steve Lander has been an author since 1996, with experience in the fields of economic services, realty and also innovation. The purpose of this concern submission tool is to provide basic education and learning on credit rating reporting. The Ask Experian team can not respond to each question separately. Nonetheless, if your inquiry is of interest to a wide audience of customers, the Experian https://finance.yahoo.com/news/wesley-financial-group-sees-increase-150000858.html team may include it in a future post as well as might likewise share reactions in its social media outreach. If you have a concern, others likely have the same concern, too. By sharing your inquiries and also our answers, we can assist others as well.